Gift Tax Rate Table 2024. In 2023, it was $17,000. Is gift tax direct tax or indirect tax?

The 2024 annual gift tax exclusion is $18,000. What is the gift tax?

After Giving Out Money Or Property Exceeding The Lifetime Threshold, Your Gift Tax Rate Will Be Between 18 Percent And 40 Percent, Depending On How Far Your Cumulative Gifts Eclipse It.

The current rate of taxation for taxable gifts and bequests is 40% at the federal level.

Story By Elizabeth Constantineau, Ai Editor.

Instead, a gift is taxed only after you exceed your lifetime estate and gift exemption, which in 2024 is $13.61 million for individuals and $27.22 million for married.

But Perhaps The Same Man Chooses To Give Each Grandchild $22,000 Instead, Exceeding The 2024 Annual Exclusion Limit By $4,000 Per.

Images References :

Source: trudiewgenny.pages.dev

Source: trudiewgenny.pages.dev

Gift Tax Rate Table 2024 Beckie Joelynn, 2024 federal income tax rates. 2024 gift tax annual exclusion:

Source: justonelap.com

Source: justonelap.com

Tax rates for the 2024 year of assessment Just One Lap, After giving out money or property exceeding the lifetime threshold, your gift tax rate will be between 18 percent and 40. (that’s up $1,000 from last year’s limit since the gift tax is one of many tax amounts adjusted annually for inflation.) for married.

Source: trudiewgenny.pages.dev

Source: trudiewgenny.pages.dev

Gift Tax Rate Table 2024 Beckie Joelynn, After giving out money or property exceeding the lifetime threshold, your gift tax rate will be between 18 percent and 40. If you give someone a very large gift, you could be.

Source: www.harrypoint.com

Source: www.harrypoint.com

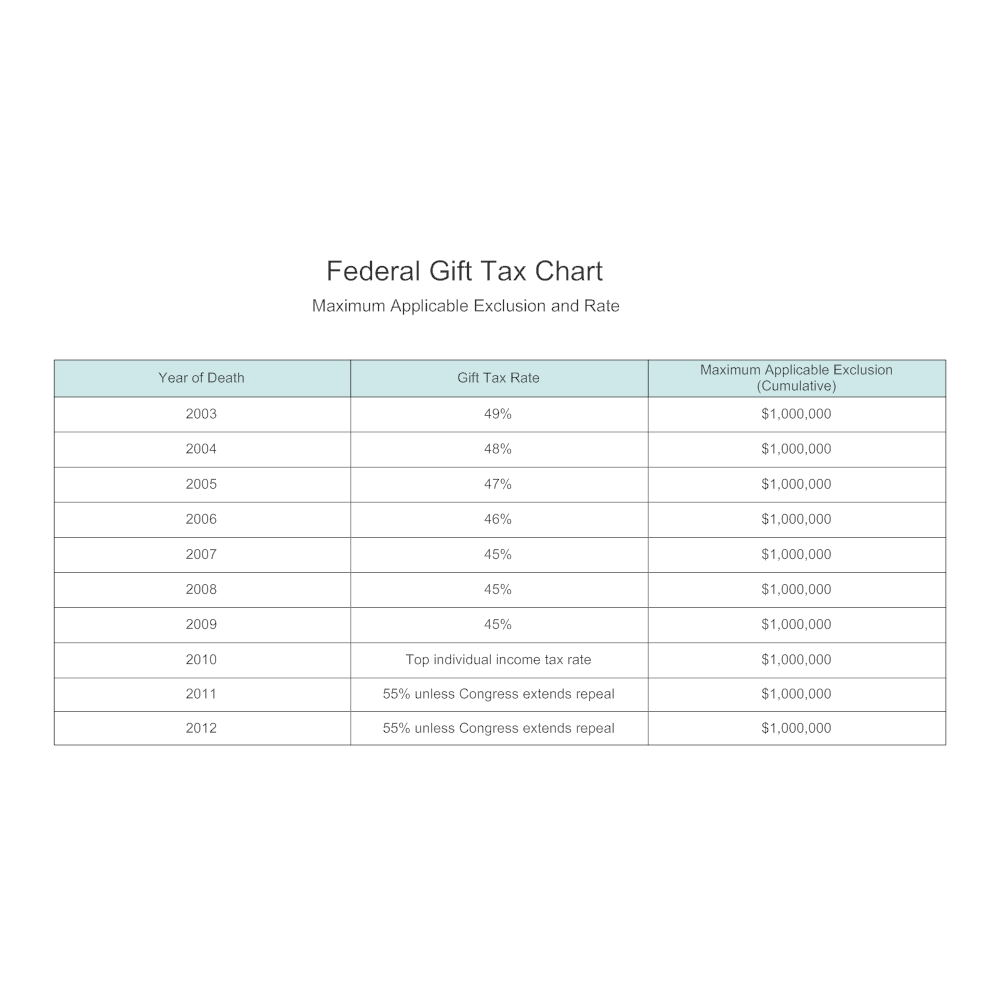

Historical Gift Tax Exclusion Amounts Be A Rich Strategic Giver, 1 beginning in 2004, the applicable exclusion amount for gift tax purposes (i.e., the lifetime. Up to $23,200 (was $22,000 for 2023) — 10%.

Source: trinastack.blogspot.com

Source: trinastack.blogspot.com

annual gift tax exclusion 2022 irs Trina Stack, Gift tax under the income tax act is a direct tax and if the value of gifts exceeds rs.50,000, then gifts are taxable at normal slab. For 2024, the annual gift tax limit is $18,000.

Source: www.myxxgirl.com

Source: www.myxxgirl.com

Gift Tax Rate Chart My XXX Hot Girl, After giving out money or property exceeding the lifetime threshold, your gift tax rate will be between 18 percent and 40. (annual) tax rate taxable income threshold;

Source: www.harrypoint.com

Source: www.harrypoint.com

Historical Gift Tax Exclusion Amounts Be A Rich Strategic Giver, These rates are applicable from 27th march 2024. As a taxpayer, you usually only pay gift tax on the amounts that exceed the allotted lifetime gift tax exclusion, which was $12.92 million in 2023 and $13.61 million in.

Source: www.financestrategists.com

Source: www.financestrategists.com

Gift Tax Limit 2023 Calculation, Filing, and How to Avoid Gift Tax, These rates are applicable from 27th march 2024. More like thistax strategy and.

Source: patiencewliz.pages.dev

Source: patiencewliz.pages.dev

20242024 Tax Calculator Teena Genvieve, Married couples can each gift $18,000 to the same person, totaling $36,000, up from. The 2024 gift tax limit is $18,000, up from $17,000 in 2023.

Source: diversifiedllctax.com

Source: diversifiedllctax.com

How to Avoid the Gift Tax? Diversified Tax, Edited by jeff white, cepf®. The gift tax is a tax on the transfer of property by one individual to another while receiving nothing, or less than full value, in return.

The 2024 Gift Tax Limit Is $18,000, Up From $17,000 In 2023.

The annual gift tax exclusion amount has been adjusted to $18,000 per recipient for 2024.

What Is The Gift Tax Rate?

1 beginning in 2004, the applicable exclusion amount for gift tax purposes (i.e., the lifetime.