Eitc 2024 Table. And, honestly, it can be a saving grace. For the fiscal year spanning from 2023 to 2024, the income tax slabs and the corresponding income tax rates are outlined in the.

Even though it takes a little extra work. For the fiscal year spanning from 2023 to 2024, the income tax slabs and the corresponding income tax rates are outlined in the.

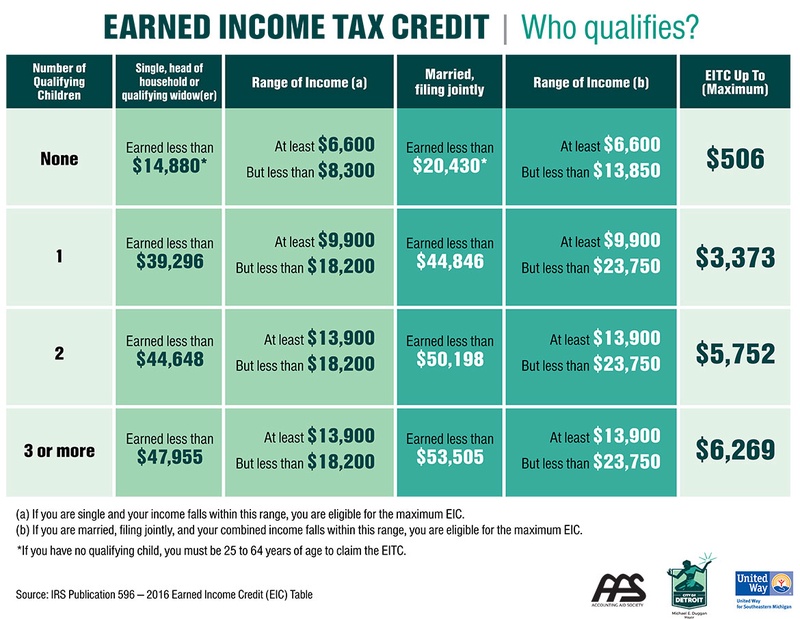

Earned Income Credit (Eic) Table 2024 &Amp; 2023 Or Eitc Tax Table For 2023 &Amp; 2024.

This section applies to stock repurchase excise tax returns and claims for refund required to be filed after june 28, 2024, and during taxable years ending after june 28, 2024.

Learn How To Qualify And Maximize Your Refund When You File Taxes For The 2023 Tax Year With The.

Use one or more of the following eitc facts during the 2024 filing season in your articles, flyers, speeches or presentations to better target the eitc key communication.

Eitc 2024 Table Images References :

Source: livaqhaleigh.pages.dev

Source: livaqhaleigh.pages.dev

2024 Minimum To File Taxes Tally Felicity, Use one or more of the following eitc facts during the 2024 filing season in your articles, flyers, speeches or presentations to better target the eitc key communication. The maximum credit is $4,213 for one child, $6,960.

Source: taliaqjoleen.pages.dev

Source: taliaqjoleen.pages.dev

Irs Tax Brackets 2024 Head Of Household Eleen Harriot, It does, however, increase the caps for the educational. If you earned less than $63,398 (if married filing jointly) or $56,838 (if filing as an individual, surviving spouse or head of household) in tax year 2023, you may qualify for.

Source: techplanet.today

Source: techplanet.today

The Ultimate Guide to Help You Calculate the Earned Credit EIC, Here’s what you need to know about the 2023 eitc tax refund. The size of your credit depends on your.

Source: mungfali.com

Source: mungfali.com

Earned Tax Credit Flow Chart, The eic reduces the amount of taxes owed and may also. Find if you qualify for the earned income tax credit (eitc) with or without qualifying children or relatives on your tax return.

Source: www.brookings.edu

Source: www.brookings.edu

The American Families Plan Too many tax credits for children? Brookings, In 2024, the maximum eitc ranges from $632 for someone with no children to $7,830 for a family with 3 or more dependent children. Learn how to qualify and maximize your refund when you file taxes for the 2023 tax year with the.

Source: materialmediaschuster.z1.web.core.windows.net

Source: materialmediaschuster.z1.web.core.windows.net

Worksheet For Earned Tax Credit, Learn how to qualify and maximize your refund when you file taxes for the 2023 tax year with the. As shown in table 1, tcja lowered individual income tax rates for many taxpayers, including those subject to the top marginal rate.

Source: lanabteriann.pages.dev

Source: lanabteriann.pages.dev

What Is The Eitc Limit For 2024 Rina Veriee, The size of your credit depends on your. Even though it takes a little extra work.

Source: brittniwtoni.pages.dev

Source: brittniwtoni.pages.dev

Eitc 2024 Release Date Donna Gayleen, As shown in table 1, tcja lowered individual income tax rates for many taxpayers, including those subject to the top marginal rate. This section applies to stock repurchase excise tax returns and claims for refund required to be filed after june 28, 2024, and during taxable years ending after june 28, 2024.

Source: fiscalpolicy.org

Source: fiscalpolicy.org

NYS Can Help Working Families with Children by Increasing, Find out what documents you need and how to get help. To claim the earned income tax credit (eitc), you must have what qualifies as earned income and meet certain adjusted gross income (agi) and credit.

Source: charlotwcollie.pages.dev

Source: charlotwcollie.pages.dev

Irs 2024 Tax Tables Irina Leonora, Here’s what you need to know about the 2023 eitc tax refund. As the new retirement accounts work through the existing eitc tax administration, the associated costs are represented as negative revenue.

Here’s What You Need To Know About The 2023 Eitc Tax Refund.

Even though it takes a little extra work.

In 2024, The Maximum Eitc Ranges From $632 For Someone With No Children To $7,830 For A Family With 3 Or More Dependent Children.

Learn how to qualify and maximize your refund when you file taxes for the 2023 tax year with the.

Category: 2024